Canaan Secures $72M from Brevan Howard, Galaxy, and Weiss as Bitcoin Stocks Slide

Bitcoin miner manufacturer Canaan has secured a $72 million equity investment from Brevan Howard, Galaxy Digital, and Weiss Asset Management in a step to deepen ties with institutional investors.

Canaan said in a release on Tuesday that was made through the purchase of 63.7 million American depositary shares (ADSs) at $1.131 per ADS, each representing 15 Class A ordinary shares.

Canaan noted that the deal involves no warrants, options, or other derivative instruments, touting it as a straightforward equity transaction that underscores investor confidence in its fundamentals.

Canaan said the proceeds will bolster its balance sheet and reduce reliance on future at-the-market or other dilutive fundraising efforts. The announcement came as Canaan’s shares fell 15% on Tuesday, trading lower alongside a broader slump in the cryptocurrency market that dragged down several bitcoin-related equities.

The investment marks a strategic shift for the mining hardware manufacturer, which has been expanding its capital-markets footprint and courting long-term institutional backers amid increased competition in the Bitcoin mining equipment sector.

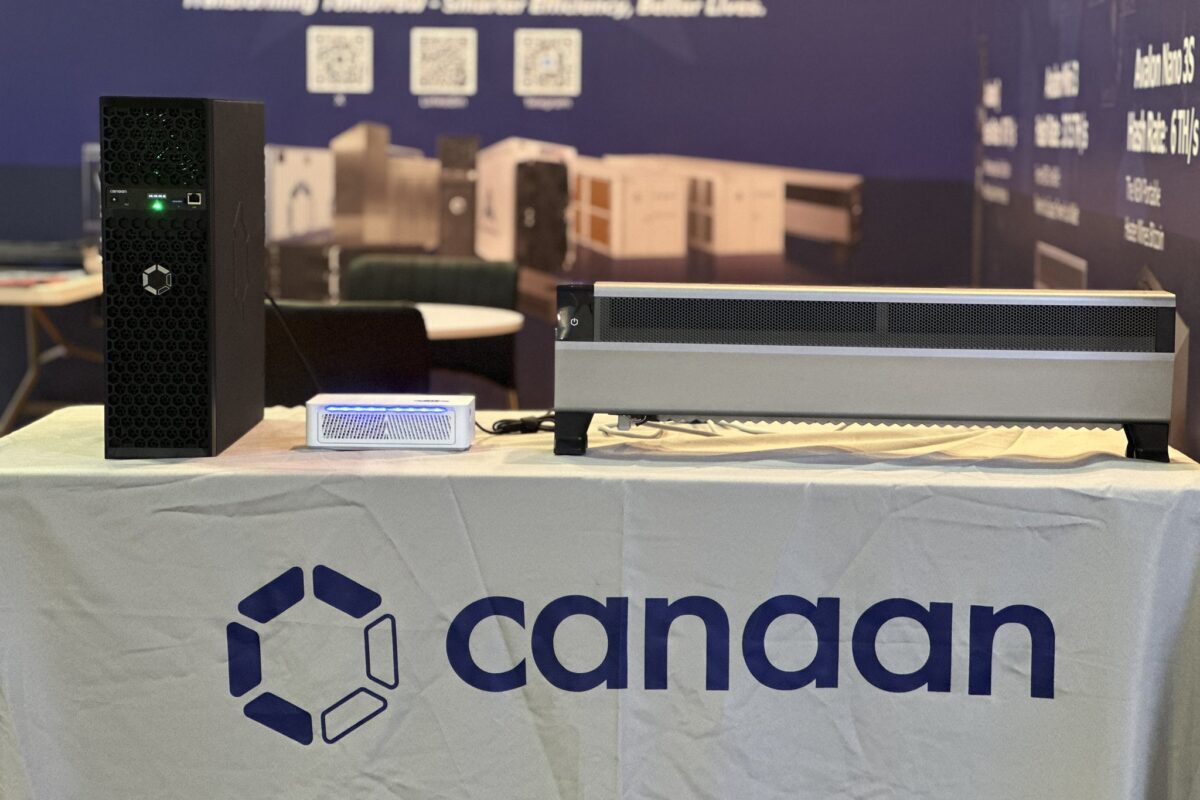

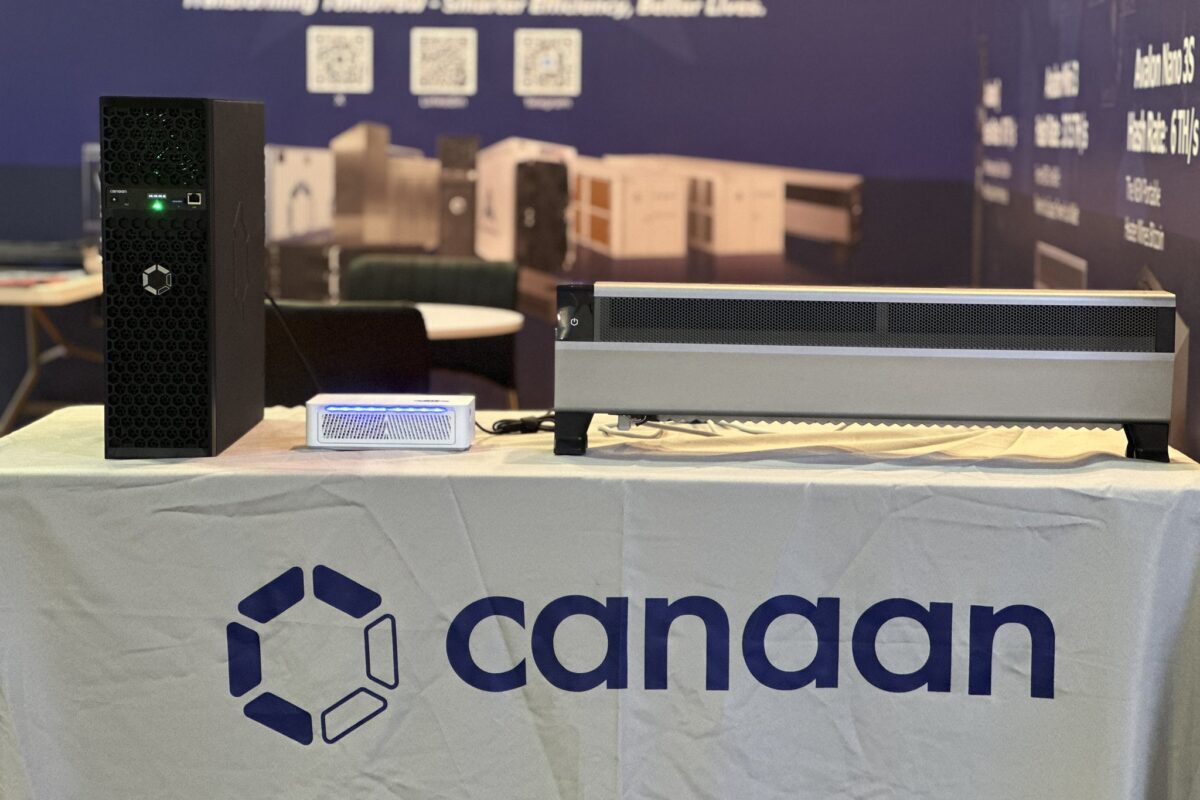

Canaan recently launched its Avalon A16 series mining rigs, matching the efficiency levels of leading rivals such as Bitmain’s S21 series, as part of its broader effort to maintain competitiveness in a tightening market.

RELATED ARTICLES

MORE NEWS

Canaan Launches A16 Series Bitcoin Miner With 12.8 J/TH Efficiency

Oct 28, 2025

Canaan Launches 2.5MW Bitcoin Mining Pilot in Canada to Tap Stranded Gas

Oct 13, 2025

Canaan Shares Surge 18% on Record 50,000-Unit Avalon Bitcoin Miner Order in U.S.

Oct 2, 2025

Canaan to Deploy 20 MW of Avalon Bitcoin Miners at Soluna’s Texas Site

Oct 1, 2025

HIVE, Bitdeer and Cipher Drive August Hashrate Growth Among Public Bitcoin Miners

Sep 9, 2025