MARA, Riot Diverge on Bitcoin Mining Financing in Q2

Two of the largest U.S. Bitcoin mining giants took contrasting approaches to capital raising in Q2, with MARA ramping up equity issuance while Riot relied more on debt financing and Bitcoin sales.

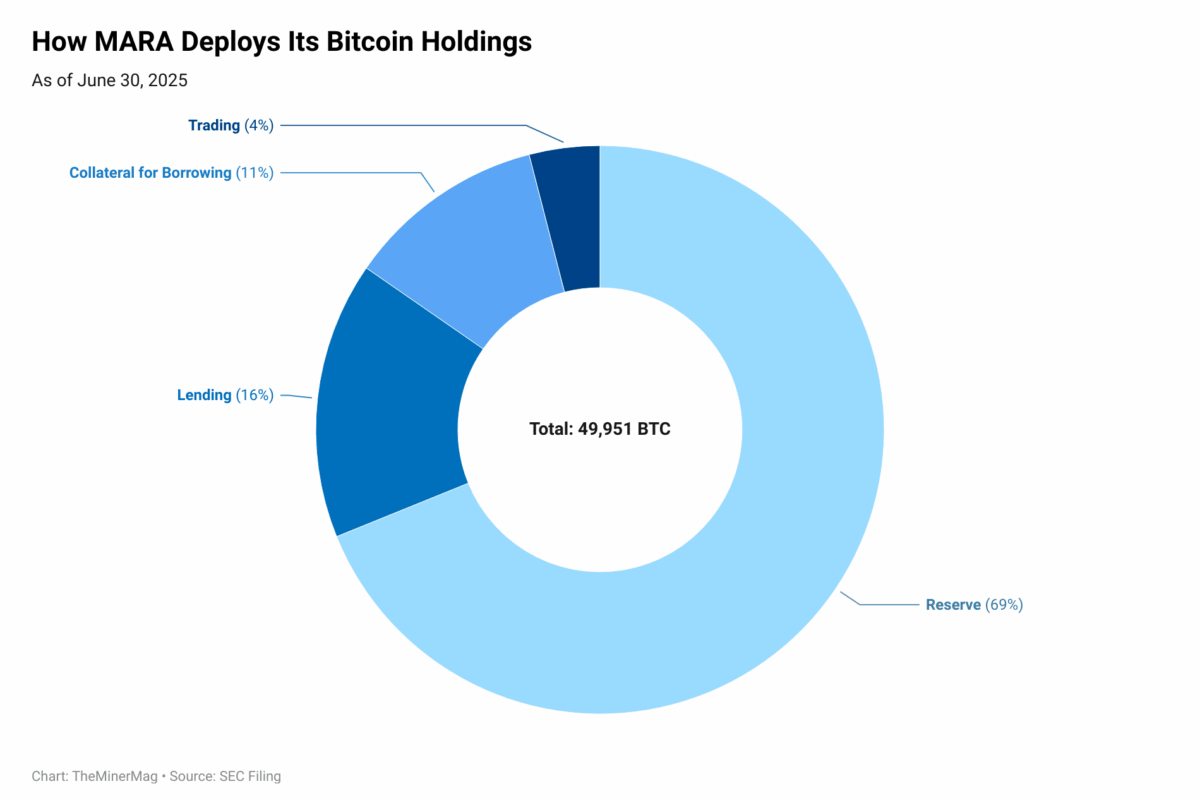

MARA raised $204 million from stock sales during the quarter, more than doubling the $80 million raised in Q1, as it maintained its policy of retaining all mined Bitcoin in treasury. The company did not tap its interest-bearing credit facility in Q2, having already drawn $150 million in the first quarter, according to its Q2 filing.

After quarter-end, MARA executed a major financing move by issuing $1 billion in zero-coupon convertible notes due 2032.

Riot, by contrast, slowed its equity fundraising to $51 million in Q2 from $70 million in Q1, and sold 96.5% of its quarterly Bitcoin production — 1,377 BTC out of 1,427 BTC mined — to fund operating expenses.

Riot established an at-the-market offering program in August 2024 for raising up to $750 million. As of June 30, 2025, approximately $238.3 million were still available for sale under the program.

Riot also turned to debt, increasing its credit-based borrowings to $251 million in Q2 from zero in the prior quarter. Riot first entered into a $100 million credit facility with Coinbase in April, later upsizing the commitment to $200 million, which it has now fully drawn.

The contrasting financing strategies reflect different treasury philosophies: Marathon adheres to a “100% HODL” policy, using capital markets to fund operations and growth, while Riot has shifted toward a blend of Bitcoin sales and credit facilities to support growth.

RELATED ARTICLES

MORE NEWS

MARA Sues to Block Texas County Vote Creating Town Around Its Bitcoin Mine

Nov 3, 2025

Miner Weekly: Bitcoin Mining Debt Set for New Records — But This Time It’s Different

Oct 16, 2025

MARA Sells Half of Mined Bitcoin for First Time in Over a Year as Uptime Improves

Oct 4, 2025

MARA to Acquire Majority Stake in EDF’s HPC Subsidiary Exaion for $168 Million

Aug 11, 2025

Miner Weekly: MARA’s Bitcoin Deployment Implies Up to 6.5% Annualized Yield – For Now

Jul 31, 2025

Riot Stock Jumps 12% as AMD Deal Anchors Texas AI Data Center Expansion

Jan 16, 2026