MARA Sells Half of Mined Bitcoin for First Time in Over a Year as Uptime Improves

MARA has sold bitcoin from its monthly production for the first time in over a year, ending a 16-month streak of full hodl mode.

According to MARA’s September update, it liquidated 49.32% of the 736 bitcoin it mined, marking a notable shift in treasury strategy as the mining sector adapts to the recent hashprice squeeze due to rising network difficulty.

The sale coincided with an increase in operational uptime. MARA's realized hashrate rose 15.12% month-over-month to 53.3 EH/s, representing 88.27% of its installed capacity. That improved fleet uptime helped the company capture approximately 5.15% of all bitcoin block rewards mined globally in September.

As of the end of the month, MARA held 52,850 BTC on its balance sheet, valued at approximately $6.3 billion.

While MARA had intermittently sold BTC in previous years, it had maintained a full “hodl” posture since May 2024, banking all mined bitcoin amid a fluctuating hashprice environment. The decision to resume sales may reflect efforts to strengthen liquidity or fund ongoing infrastructure investments, particularly as miners face rising network difficulty and muted transaction fee revenues.

RELATED ARTICLES

MORE NEWS

MARA Sues to Block Texas County Vote Creating Town Around Its Bitcoin Mine

Nov 3, 2025

Miner Weekly: Bitcoin Mining Debt Set for New Records — But This Time It’s Different

Oct 16, 2025

MARA to Acquire Majority Stake in EDF’s HPC Subsidiary Exaion for $168 Million

Aug 11, 2025

MARA, Riot Diverge on Bitcoin Mining Financing in Q2

Aug 5, 2025

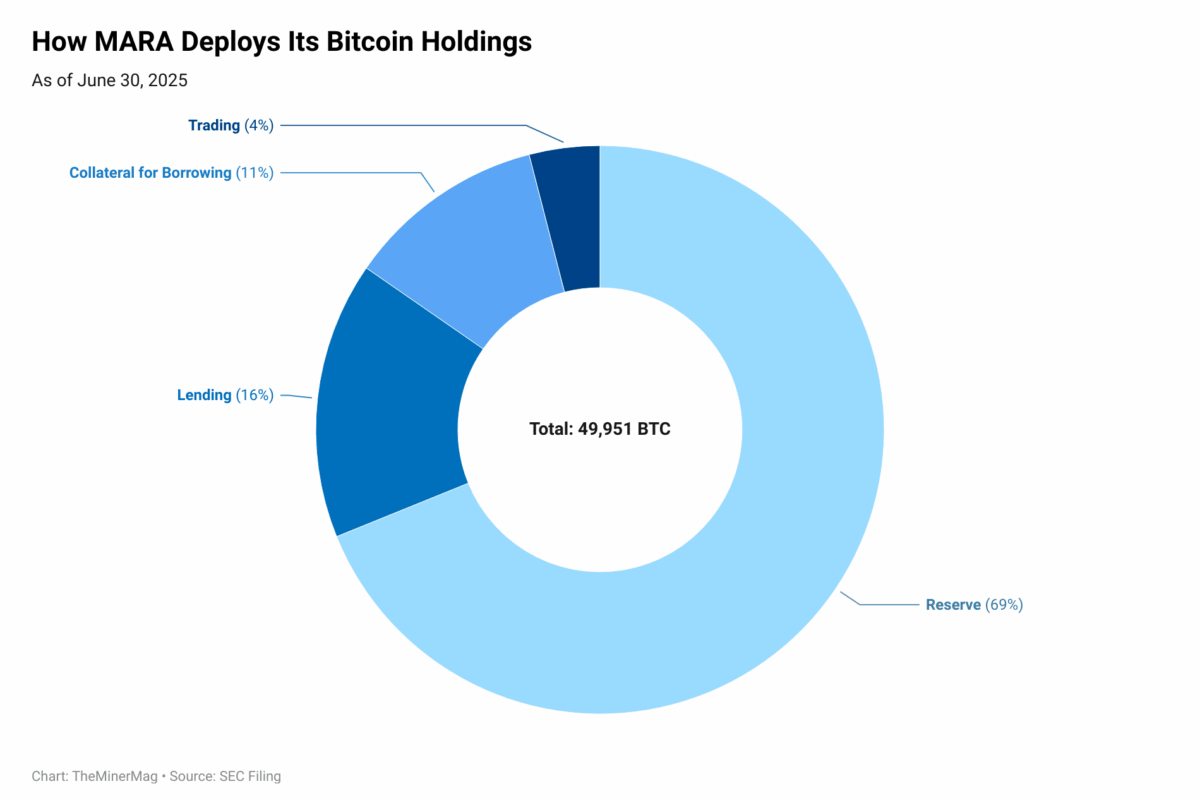

Miner Weekly: MARA’s Bitcoin Deployment Implies Up to 6.5% Annualized Yield – For Now

Jul 31, 2025