MARA Plans $1 Billion Convertible Notes to Bolster Bitcoin Holdings, Repay Debt

Bitcoin mining giant MARA is raising up to $1 billion through a new convertible bond offering as it continues to rely on capital markets to fund operations while preserving its Bitcoin treasury.

The company said Tuesday it intends to sell $850 million in zero-coupon convertible notes due 2032 in a private placement to qualified institutional buyers, with an option for underwriters to purchase an additional $150 million within 13 days of issuance.

Proceeds from the offering will be used in part to repurchase up to $50 million of MARA’s existing 1.00% convertible notes raised in 2021 and due 2026, with the remainder allocated to capped call hedging strategies, bitcoin acquisitions, and general corporate purposes such as working capital, strategic investments, and debt repayment.

The financing strategy is consistent with MARA’s long-standing 100% HODL policy, under which it retains all newly mined bitcoin rather than selling it to cover expenses.

To support this approach, the company has leaned heavily on equity and debt financing. In Q4 alone, MARA raised nearly $700 million through stock offerings and $1.8 billion by issuing convertible bonds and bitcoin-backed loans.

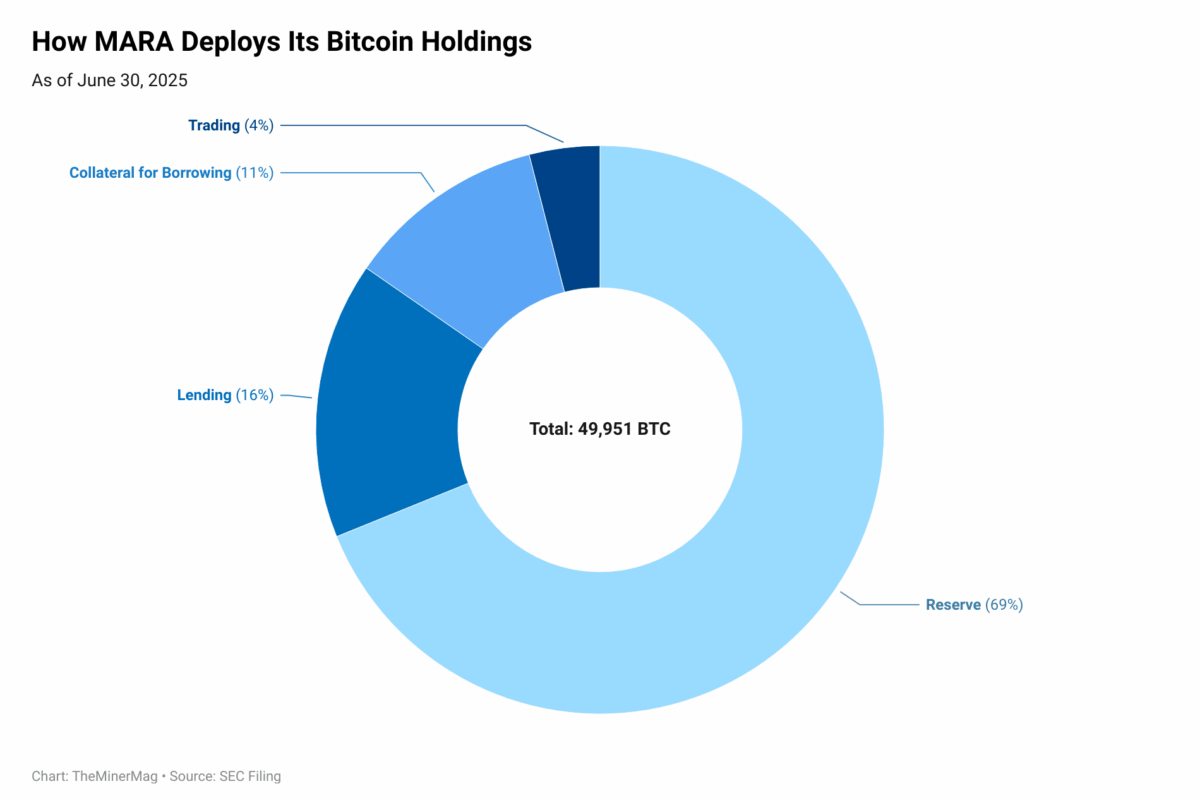

In March, MARA established a $2 billion at-the-market (ATM) equity issuance program. As of July, MARA holds approximately 50,000 BTC with 58 EH/s in deployed hashrate.

RELATED ARTICLES

MORE NEWS

MARA Sues to Block Texas County Vote Creating Town Around Its Bitcoin Mine

Nov 3, 2025

Miner Weekly: Bitcoin Mining Debt Set for New Records — But This Time It’s Different

Oct 16, 2025

MARA Sells Half of Mined Bitcoin for First Time in Over a Year as Uptime Improves

Oct 4, 2025

MARA to Acquire Majority Stake in EDF’s HPC Subsidiary Exaion for $168 Million

Aug 11, 2025

MARA, Riot Diverge on Bitcoin Mining Financing in Q2

Aug 5, 2025

Miner Weekly: MARA’s Bitcoin Deployment Implies Up to 6.5% Annualized Yield – For Now

Jul 31, 2025